How to Build Wealth with Real Estate: Slow, Steady, and Strategic Approach

Real estate is one of the most reliable paths to long-term wealth—but it’s not always about chasing quick wins. Building wealth slowly, steadily, and strategically ensures financial security, sustainable growth, and resilience against market fluctuations. This guide explains how investors can achieve this approach, particularly in markets like Dubai.

Why Slow and Steady Wins in Real Estate

Many investors are tempted by “get-rich-quick” schemes, flipping properties for short-term gains. While profits are possible, the risk is high. A slow and steady strategy focuses on:

-

Long-term capital appreciation

-

Consistent rental income

-

Diversified property portfolio

-

Risk management and market timing

This strategy emphasizes financial discipline and strategic planning rather than speculation.

Step 1: Start With a Clear Financial Plan

Before buying any property, determine your:

-

Budget and cash flow: How much can you invest without straining finances?

-

Investment horizon: Are you looking for 5, 10, or 20-year growth?

-

Risk tolerance: Low, medium, or high-risk investments?

-

Return expectations: Rental yield vs. capital appreciation

A well-defined plan ensures every property aligns with your long-term wealth goals.

Step 2: Choose the Right Market and Location

Location is the most critical factor in real estate wealth building. Look for areas that offer:

-

Strong rental demand

-

Planned infrastructure and transport development

-

Growing population and economic activity

-

Potential for future appreciation

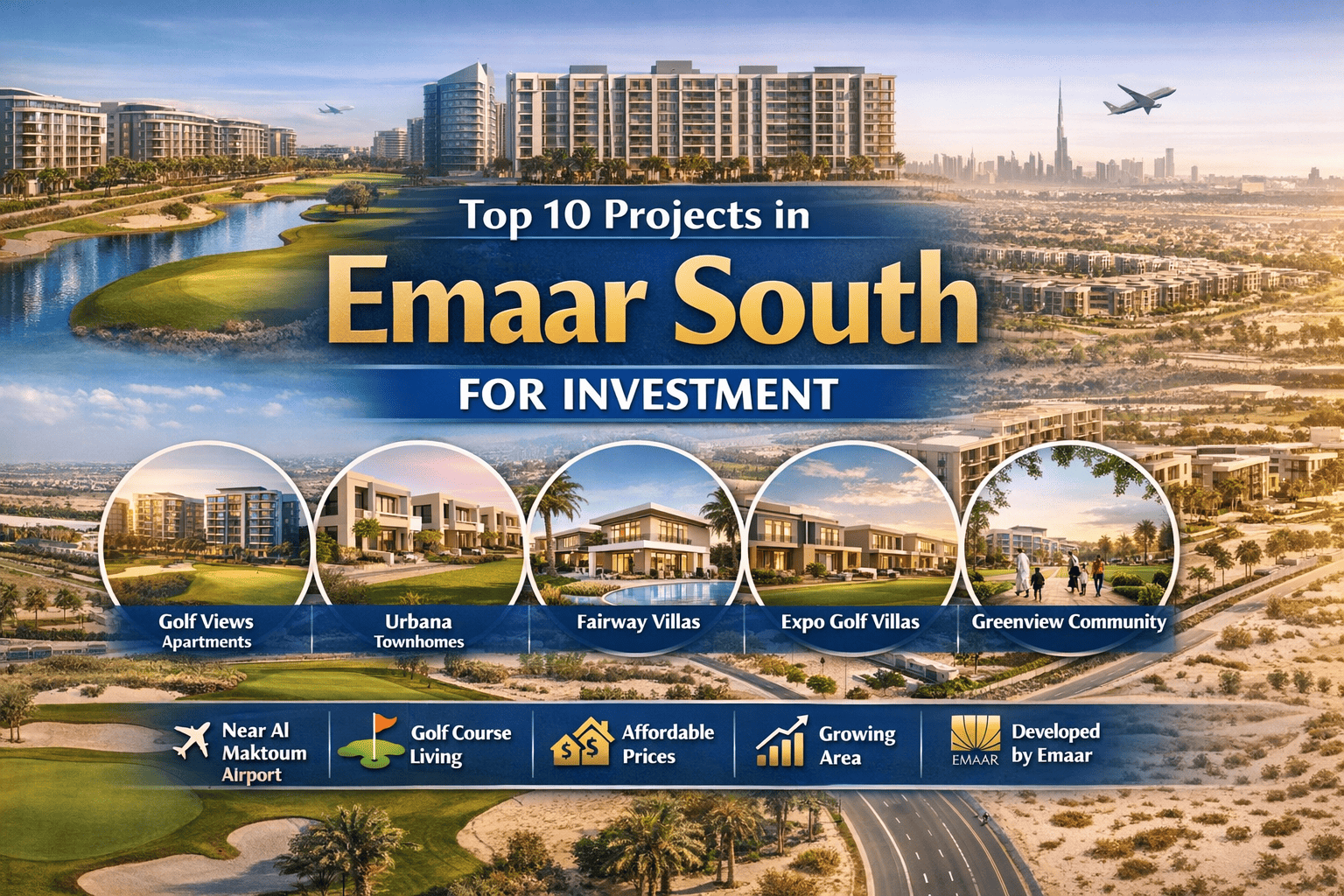

In Dubai, examples include Downtown Dubai, Dubai Marina, Business Bay, Dubai Creek Harbour, and emerging areas like Dubai South.

Step 3: Focus on Cash Flow Properties

While capital appreciation is important, steady cash flow provides stability:

-

Invest in rental properties that generate positive income

-

Target 5–8% rental yields, depending on location

-

Consider furnished short-term rentals for higher income potential

Steady rental income allows reinvestment and compound growth over time.

Step 4: Leverage Strategically

Using mortgages can amplify returns—but only if used wisely:

-

Avoid over-leveraging

-

Maintain sufficient liquidity for expenses

-

Choose competitive interest rates and manageable tenure

-

Use leverage to expand portfolio without straining cash flow

Strategic leverage lets you build wealth faster while staying safe during market slowdowns.

Step 5: Diversify Your Property Portfolio

Don’t put all your eggs in one basket:

-

Mix residential and commercial properties

-

Consider different districts or emerging neighborhoods

-

Include off-plan and ready-to-move units for balance

Diversification spreads risk and ensures smoother long-term growth.

Step 6: Reinvest and Compound Your Gains

Wealth grows when profits are reinvested:

-

Use rental income to pay down mortgage or acquire more properties

-

Reinvest capital gains from sold properties into higher-potential assets

-

Take advantage of off-plan payment plans to enter new projects without huge upfront cash

Compound growth over 10–20 years creates significant financial security.

Step 7: Monitor the Market and Stay Patient

Patience is key in slow, steady wealth building:

-

Track property prices, rental yields, and market trends

-

Avoid emotional decisions during short-term market fluctuations

-

Adjust strategy only when long-term fundamentals shift

Consistency and discipline often outperform quick speculation.

Benefits of a Slow and Strategic Real Estate Approach

-

Predictable income and cash flow

-

Lower risk compared to flipping or speculative investments

-

Long-term capital appreciation

-

Opportunity to build multi-generational wealth

-

Less stress and financial volatility

Final Thoughts

Building wealth with real estate doesn’t require luck—it requires strategy, patience, and smart decision-making. By focusing on slow, steady, and strategic investments, you can create a portfolio that generates consistent income, appreciates over time, and secures your financial future.